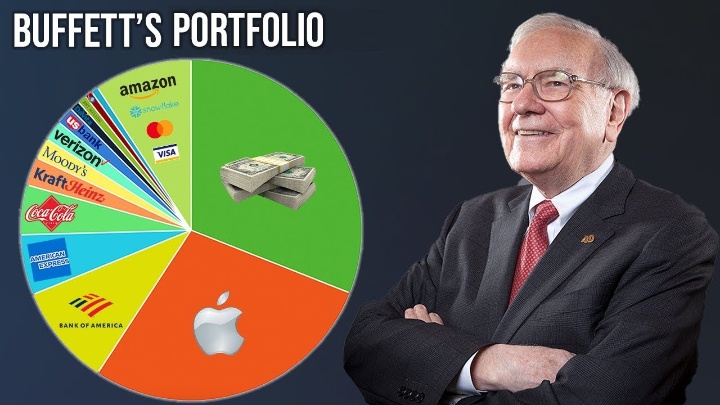

Buffett Says to Set It And Forget It

Warren Buffett, often referred to as the “Oracle of Omaha,” is one of the most successful investors in history. His investment strategies and philosophies have been studied and emulated by investors worldwide. This article explores the types of investments Warren Buffett would likely consider today, based on his well-documented principles and recent market conditions.

Buffett’s Core Investment Principles

Value Investing

Buffett is a staunch advocate of value investing, a strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. This approach requires a deep understanding of the company’s fundamentals, including its business model, management team, and financial health.

Long-Term Perspective

Buffett famously holds investments for long periods, often stating that his favorite holding period is “forever.” This long-term perspective allows for the compounding of returns and reduces the impact of market volatility.

Economic Moats

Buffett looks for companies with a strong competitive advantage, or “economic moat,” which can protect them from competitors. This might include brand strength, proprietary technology, or significant market share.

Sectors Warren Buffett Would Likely Invest In

Financial Services

Buffett has always favored financial services, particularly banks and insurance companies. He appreciates the steady cash flows and the critical role these institutions play in the economy.

- Banks: Strong balance sheets, prudent risk management, and a focus on traditional banking activities are key attributes Buffett seeks in banks. Examples include Bank of America and Wells Fargo.

- Insurance: Companies like GEICO, which offer consistent underwriting profits and invest their float wisely, align with Buffett’s investment criteria.

Technology

While historically cautious of technology stocks, Buffett has recently embraced this sector, acknowledging the essential role technology plays in modern business.

- Apple Inc.: Buffett’s significant investment in Apple showcases his belief in the company’s strong brand, loyal customer base, and robust financials.

Consumer Goods

Buffett favors companies that produce everyday products with predictable demand. These firms often have strong brand loyalty and pricing power.

- Coca-Cola: Buffett’s long-term investment in Coca-Cola highlights his preference for companies with a timeless appeal and a wide economic moat.

- Procter & Gamble: Known for its portfolio of trusted brands, P&G represents the type of consumer goods company Buffett likes.

Utilities and Energy

Buffett appreciates the stable earnings and regulated nature of the utility sector. His investments in energy often focus on sustainable and renewable sources.

- Berkshire Hathaway Energy: This subsidiary of Buffett’s conglomerate reflects his commitment to investing in stable, regulated utilities and renewable energy projects.

Healthcare

Buffett has shown an increasing interest in the healthcare sector, recognizing the growth potential and essential nature of healthcare services and products.

- Pharmaceuticals: Investments in companies like Pfizer and Merck demonstrate his focus on firms with strong R&D capabilities and a robust pipeline of products.

Investment Strategies Aligned with Buffett’s Philosophy

Focus on Fundamentals

Investors should prioritize companies with strong financials, including solid earnings, manageable debt levels, and efficient operations. Analyzing financial statements and understanding the business model are crucial steps.

Diversification

While Buffett advocates for concentration in one’s best ideas, he also recognizes the importance of diversification to mitigate risk. A balanced portfolio across different sectors can provide stability and growth.

Patience and Discipline

Following Buffett’s example, investors should remain patient and disciplined, avoiding impulsive decisions based on market fluctuations. Staying focused on the long-term potential of investments is key.

Video About Warren Buffett’s Advice on Investing

This video we made about Warren Buffett’s investing advice might be helpful:

Link: Warren Buffet Invest in.

Conclusion

Warren Buffett’s investment approach, grounded in value investing, long-term perspective, and the search for economic moats, continues to guide his choices across various sectors. By focusing on financial services, technology, consumer goods, utilities, and healthcare, and adhering to fundamental analysis, diversification, and patience, investors can align their strategies with Buffett’s timeless principles.

Also Read: How to Protect Your Identity and Prevent Financial Fraud.

1 thought on “What Would Warren Buffett Invest In?”